- Home

- The Nepal-Global Opportunity Gap: Why We Are Falling Behind

The Nepal-Global Opportunity Gap: Why We Are Falling Behind

The Nepal-Global Opportunity Gap: Why We Are Falling Behind and How We Fix It

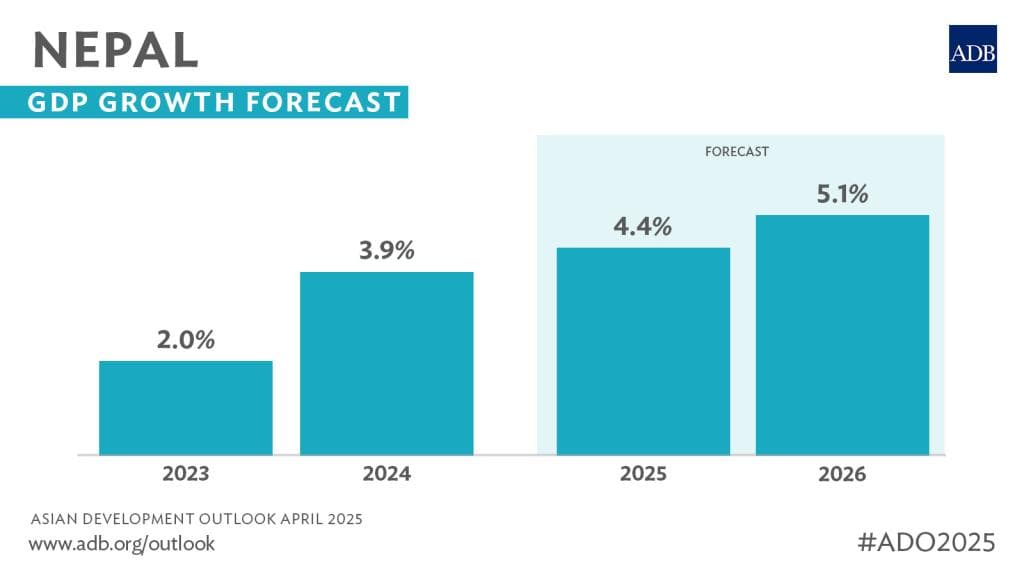

Nepal is at a critical moment. While the country has immense talent and potential, the economy is still struggling to catch up with its neighbors. The World Bank and Asian Development Bank project growth of around 4.5–5% for 2025, but this growth is still driven largely by traditional sectors like tourism, hydropower, and agriculture. The real engine of modern economic power—innovation and entrepreneurship—remains underutilized.

The Paradox: We Have Talent, But It’s Leaving

Nepal has a massive, hidden asset: its people. We have engineers graduating from top global universities, entrepreneurs launching businesses in the US and Australia, and professionals working in Fortune 500 companies. The talent exists.

But there’s a problem. A huge portion of Nepal’s skilled human capital—around 50%—is contributing to the global economy, not Nepal’s.

This isn’t just about people moving abroad for jobs. It’s about a lost economic opportunity. When a brilliant Nepali engineer builds a product in Silicon Valley, that value stays there. When a Nepali investor funds a startup in Singapore, that capital grows there. Nepal gets remittances, which help families buy food and build houses, but it doesn’t get the investment capital that builds generational companies.

Other countries faced this same problem and fixed it. India, Vietnam, and Bangladesh didn’t just watch their talent leave—they built systems to keep them engaged. They turned "brain drain" into "brain circulation." Nepal hasn’t done that yet.

What Neighbors Are Doing And We Aren’t

To understand what’s missing, look at our neighbors.

India: The Indian diaspora organized itself. They didn’t wait for the government. They built business councils, angel networks, and mentorship programs that connect Indian founders with global expertise. Today, India’s startup ecosystem is a global force because it’s powered by this global network.

Vietnam & Bangladesh: These countries realized their diaspora was a strategic asset. They created specific funds and platforms to encourage investment and knowledge transfer. Now, they are seeing the results in their growing tech and manufacturing sectors.

Nepal’s Reality: In Nepal, we have institutions—government bodies, chambers of commerce, and diplomatic missions—that are supposed to do this work. But in practice, they haven’t been able to create a unified platform. The result? Individual Nepalis succeed globally, but Nepal as a nation remains invisible in the global startup scene.

The Economic Consequence

Because of this coordination failure, Nepal’s economy suffers in specific ways:

1. Capital doesn’t build companies:

Nepal receives billions in remittances, but most of it goes to consumption. It doesn’t flow into productive sectors like technology or manufacturing. There’s no easy way for a diaspora investor to fund a high-growth Nepali startup, so the money stays in foreign banks.

2. Brain drain becomes permanent:

Over 2,000 young people leave Nepal every day. Without a thriving local ecosystem to attract them back or engage them remotely, their skills are lost to Nepal forever.

3. No global identity:

Investors look at South Asia and see India. They see rising stars like Vietnam. Nepal is often overlooked, not because we lack potential, but because we lack a clear, unified voice in the global market.

The Structural Barriers

It’s not just about missing connections. There are real barriers on the ground:

-

Limited Entrepreneurial Support: While things are improving with policies like the new Startup Policy and Startup Fest, Nepal still lacks a mature support system for founders. We need more than just grants; we need mentorship, market access, and a culture that celebrates risk-taking.

-

Fragmentation: Capital allocation is inefficient. Banks focus on collateral-based lending, leaving innovative startups without funding.

-

Institutional Silos: The government, private sector, and diaspora organizations often work in isolation. There’s no single platform bringing everyone together to drive economic growth.

How Nivesh.Fund is Closing the Gap

Nivesh.Fund exists to solve this specific coordination problem. We aren’t just investing money; we are building the infrastructure that should have existed years ago.

1. Connecting the Diaspora:

We are creating a direct channel for Nepali professionals abroad to invest in and mentor Nepal-based companies. This turns the diaspora from passive observers into active economic participants.

2. Building a "Nepal-Global" Bridge:

We act as the intermediary between Nepal’s ecosystem and the world. We help Nepali startups access global markets and help global investors access Nepali opportunities.

3. Preparing Founders for Reality:

We know Nepal isn’t Silicon Valley. The challenges here are different—regulatory hurdles, infrastructure gaps, market size. That’s why we work with founders before we invest. We help them build resilient business models that can survive and thrive in Nepal’s actual economic context.

Why This Matters Now

Nepal’s economy is forecasted to strengthen in 2025 and 2026. We have a window of opportunity.

The difference between countries that rise and those that stagnate isn’t just resources—it’s organization. India and Vietnam proved that when you organize your talent and capital, you can change your economic destiny.

Nepal has the talent. We have the capital scattered across the globe. We have the market opportunities. What we’ve been missing is the platform to bring it all together.

Nivesh.Fund is that platform. We are betting that Nepal’s next big success story won’t happen by accident—it will happen because we finally built the bridge to make it possible.

Featured Blogs