- Home

- Beyond Stability: Architecting Nepal's Next Economic Engine

Beyond Stability: Architecting Nepal's Next Economic Engine

Dec 26, 2025

Nepal Economy

There is a difference between an economy that survives and one that evolves.

For the past decade, Nepal has mastered the art of survival. We have built a macroeconomic framework that is surprisingly resilient. Remittances flow, reserves accumulate, and the currency holds. Even now, the data tells a story of stabilization inflation is tempered, and external balances are strong.

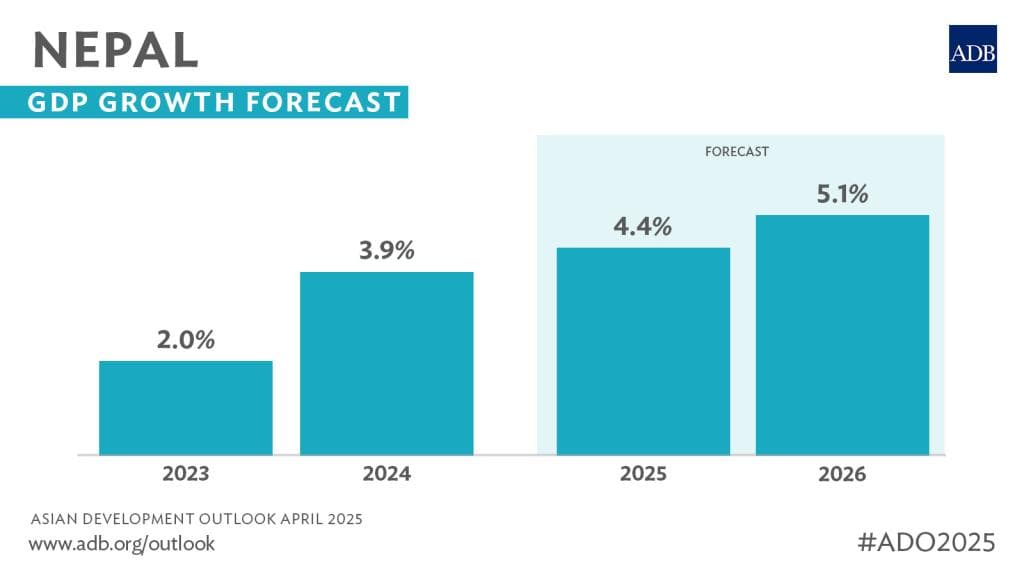

Look at the numbers. Growth has moved from 2.0% in 2023 to 3.9% in 2024. The forecasts project 4.4% in 2025 and 5.1% in 2026. On the surface, this looks like a story of steady improvement. And it is.

But here is the uncomfortable truth: growth is not the same as transformation.

Nepal's GDP numbers are trending upward. But if we are honest with ourselves, we know that stability alone is not enough. A 5% growth rate can mask a thousand structural failures. It can hide the fact that we are still exporting our best people, still importing most of our goods, and still waiting for someone else to build our future.

Stability is merely the floor; it is not the ceiling.

The Real Problem: Stability Disguises Stagnation

The deeper reality the one we rarely discuss with enough intellectual honesty is that our growth model has stalled. We are trapped in a cycle where we export our most valuable asset (human capital) and import everything else. We have stabilized the present, but we have not yet architected the future.

Yes, GDP is growing. But what is driving that growth? Not innovation. Not globally competitive companies. Not world-class exports. The growth is being driven by the same engines it always has been: remittances, tourism, hydropower, and traditional sectors.

Meanwhile, the sectors that could transform Nepal's future technology, scalable services, modern manufacturing, knowledge-based exports remain marginal in the economy's composition.

This is not a criticism of Nepal's progress. It is a diagnosis. Progress and stagnation can coexist. You can have rising numbers and a stalled system at the same time.

The Invisible Deficit

Nepal's trade deficit is visible; it is printed in newspapers every month. But our "institutional deficit" is invisible, and it is far more damaging.

We have a paradox: Nepal is not short on talent, and globally, it is not short on capital. We have engineers leading teams in Silicon Valley and investors managing portfolios in Singapore. The raw ingredients for a thriving economy exist.

The deficit lies in the piping. We lack the trusted, organized pathways to bring that global value back into domestic productivity. When a brilliant Nepali mind leaves, they don't just take their labor; they take their future networks, their mentorship capacity, and their capital allocation power.

Other nations—India, Vietnam, Ireland—turned their diaspora into their greatest economic engine.

They built institutions that allowed talent to leave, learn, and then return (physically or virtually) to build. Nepal has not yet built this bridge. We have allowed our diaspora to remain an audience to our development, rather than active architects of it.

The Window Is Now, Not Later

Here is why the timing matters. Nepal is projected to accelerate from 4.4% growth in 2025 to 5.1% in 2026. That acceleration is the "window."

Windows close. They do not stay open forever.

Most countries squander these windows. They use the good times to consume more, build more real estate, and export more of their people. They do not build institutions. They do not build productive capacity. They do not build the companies that last decades.

But some countries use these windows differently. They use them to lay the foundation for the next phase of growth. They build venture ecosystems, they formalize investment frameworks, they connect their diaspora, and they start producing companies that compete globally.

Nepal can choose which path to take.

The Nivesh Thesis: Value Creation Over Asset Allocation

In mature markets, Venture Capital is often a game of asset allocation—finding the moving train and jumping on.

In Nepal, the model must be different. Here, you cannot just find the train; you often have to lay the tracks.

This is why Nivesh.Fund operates differently. We are an ecosystem-native platform, designed for the specific friction and friction-points of the Nepali market. We reject the copy-paste approach of Silicon Valley models, which assume a level of institutional readiness that does not yet exist here.

Our thesis is built on three pillars of realism:

1. Pre-Capital Architecture

In Nepal, the check is rarely the starting point. The biggest risks to early-stage companies here are not market risks, but structural ones governance, regulatory compliance, and operational discipline.

We engage at the pre-capital stage. We do not wait for a "perfect" company to show up; we work to engineer institutional readiness before capital is deployed. We are builders first, investors second.

2. The Nepal-Global Loop

We are moving beyond the sentimental appeal to the diaspora. Sentiment does not build industries; returns do. Opportunity does.

We are constructing a "Nepal-Global" loop where diaspora capital is treated with professional rigor, directed toward high-growth domestic ventures. This allows global Nepalis to participate in Nepal's growth not as charity, but as a strategic asset class.

3. Community as a Hedge Against Fragility

In a developing market, isolation is fatal. Founders fail when they solve the same problems in silos.

We are building a community-centric model where knowledge creates a defensive moat. When one portfolio company solves a logistics hurdle or a regulatory maze, that knowledge is shared. We are building a collective intelligence that makes every subsequent venture more resilient.

The Choice

Nepal's GDP is rising. The window of opportunity is open. The macroeconomic pressure has eased, creating momentary breathing room. The digital infrastructure is finally mature enough to support scalable businesses. The regulatory environment for private equity is becoming more formalized.

We have two choices. We can use this window to drift back into our comfort zone remittance-fueled consumption and real estate speculation. Or, we can use it to build the productive engines of the next decade.

Nivesh.Fund has made its choice.

We are here to back the builders who understand that Nepal's constraints are not permanent walls, but temporary hurdles. We are here to bridge the gap between where Nepal is, and where it deserves to be.

This is not just about funding startups. This is about proving a new economic logic for Nepal—one where growth numbers are not just indicators of stability, but proof of transformation.

That is what happens when you architect the future instead of just surviving the present.

Featured Blogs

Nepal-Global